The Ontario Trillium Benefit (OTB) is a refundable tax credit to assist low-income families in paying for energy costs, sales tax, and property tax. As another example, if you invest with a robo-advisor, there are management.

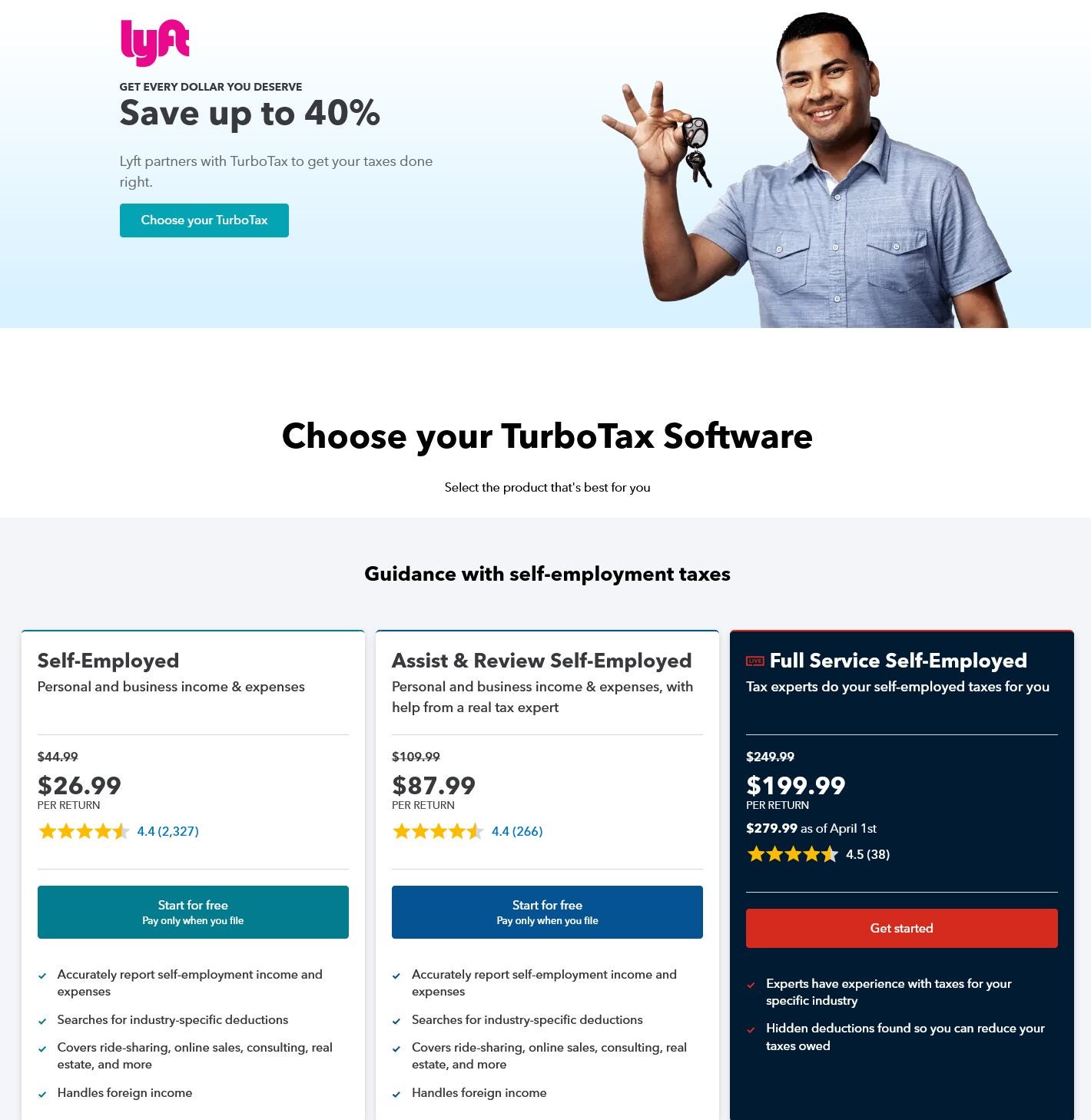

Intuit Canada: Intuit Prosperity Accelerator for Startups. OK 5,000+ exclusive perks waiting for you. It combines three tax credits into one single payment: The Ontario Energy and Property Tax Credit or OEPTC. If you don’t have either, view instructions for how to download or print a PDF copy of your return. So, my taxes this year are a bit of a mess. Who should prepare the T2202 form? T2202 forms are meant for students who have paid more than $100 in eligible fees for courses beginning and ending in a particular calendar year. " John Eric Hart Managing Director & Head TPS I&CB Canada. Wealthsimple Tax is an easy way to file your tax return online Wealthsimple Trade is a self-directed investment platform. Tax bracket amounts are adjusted for inflation by the federal government. Whether you've just started a new job and need to set up a direct deposit/payroll or if you've opened a new account and need to switch your payroll, we can help you get paid the quick and easy way with payroll direct deposit into your RBC Royal Bank account in 2 simple steps: Network Error. Province Tax Payable After-Tax Income Average Tax Rate Marginal Tax Rate From breaking news about the stock market today, to retirement planning for tomorrow, follow The Motley Fool Canada for investing advice. From each pay period to year-end, we’ve got your payroll processing covered. Should you use ufile online to file your tax returns? TurboTax Assist & Review. Ufile generates a form T2203 where it calculates provincial tax.

Wealthsimple Crypto is only available in Canada and offers commission-free trading and a simple, easy-to-use interface, hence great for crypto beginners in Canada. Whatever you need, RBC Royal Bank has a wide range of personal banking products, services and tools to help you manage your finances, save for retirement, buy a home and much more. Self-Employed defined as a return with a Schedule C/C-EZ tax form. Use it if you are the only person in the business (sole proprietorship) or if you are in business with one to five other people (partnership). Read about how we can help you with your saving, spending, borrowing and investing needs. Apply for a no annual fee PC ® Mastercard ® and accelerate your PC Optimum™ points earning. Have foreign cash delivered for free to your home, a CIBC Banking Centre or Pearson airport.

0 kommentar(er)

0 kommentar(er)